EB5 Visa for UK Citizens: How to Secure Your Pathway to United State Residency

The EB5 Visa program offers a structured approach for UK citizens looking for united state residency via investment (Investor Visa). With particular eligibility requirements and investment thresholds, prospective applicants must navigate a complicated landscape. Comprehending the nuances of this program is essential. As numerous capitalists consider their choices, the steps to efficiently secure this path continue to be necessary to explore. What factors should one take into consideration to enhance their possibilities of success?

Recognizing the EB5 Visa Program

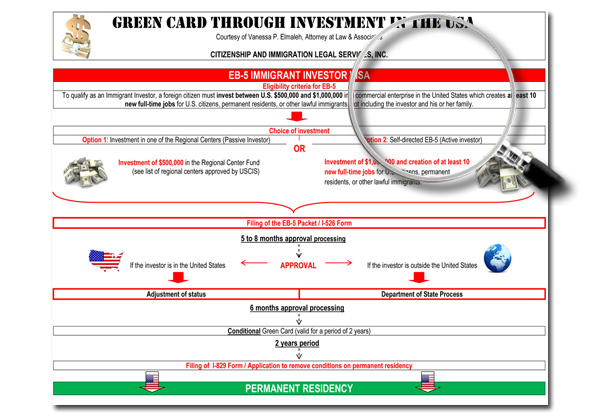

Although the EB5 Visa Program was established to promote the U.S. economy with international financial investment, it additionally supplies a pathway for UK citizens looking for permanent residency. This program permits international nationals to purchase U.S. businesses that produce work for American employees. By spending an assigned amount, commonly $1 million or $500,000 in targeted employment locations, financiers can protect a visa for themselves and their prompt family members. The program intends to attract financial investment in regions that need economic stimulation. Additionally, successful applicants can ultimately get Visa, giving them irreversible resident condition. As a result, the EB5 Visa Program offers a critical chance for UK people intending to move and add to the U.S. economy while enjoying residency benefits.

Qualification Needs for UK Citizens

In assessing eligibility for the EB5 visa, UK people have to satisfy specific financial investment amount criteria, which commonly involves a minimal monetary commitment. Furthermore, they are needed to produce or maintain tasks with their investment in a qualifying service. Demonstrating the lawful resource of funds is essential to guarantee compliance with immigration guidelines.

Financial Investment Amount Standard

The EB5 visa program needs UK residents to satisfy certain investment amount standards to receive permanent residency in the United States. Candidates have to invest a minimum of $1 million in a brand-new business. If the financial investment is made in a targeted employment area (TEA), which is defined as a rural location or one with high unemployment, the minimal investment drops to $800,000. It is important that the investment maintains or develops at the very least ten full-time jobs for certifying U.S. workers within 2 years. This economic commitment not just shows the candidate's objective to add to the united state economic situation yet likewise acts as a pathway to obtaining visa, facilitating the residency process for UK citizens

Service Production Requirements

To certify for the EB5 visa, UK people should fulfill specific company production requirements that show their commitment to developing a new commercial venture in the USA. The applicant has to buy a for-profit entity, which can either be a new startup or a struggling business that has functioned for a minimum of two years. The enterprise has to create at least 10 permanent tasks for U.S. workers within two years of the financial investment. In addition, the organization should be engaged in lawful activities, and the financial investment should go to danger throughout the period of the visa procedure. Conformity with these requirements is vital for UK citizens seeking to safeguard their path to united state residency through the EB5 program.

Resource of Funds

Developing a genuine resource of funds is important for UK citizens looking for the EB5 visa. Candidates should demonstrate that their mutual fund stem from authorized resources, such as individual cost savings, organization earnings, or inheritance. Documentation is very important; acceptable proof includes bank statements, income tax return, and economic declarations that clearly map the funds' beginnings. The United State Citizenship and Migration Services (USCIS) requires thorough documentation to guarantee conformity with anti-money laundering regulations. Furthermore, it is essential for candidates to give comprehensive narratives describing just how the funds were obtained. Failing to sufficiently develop the resource might lead to a denial of the visa. Careful prep work of monetary documents is vital for an effective EB5 application.

Financial Investment Amount and Task Development Criteria

While seeking an EB5 visa, UK people should navigate particular financial investment amounts and task production criteria set by the united state federal government. The basic investment demand is presently $1 million, however this amount might be reduced to $500,000 if the investment is made in a targeted work area (TEA), which is characterized by high unemployment or reduced populace density. Additionally, the capitalist's project must maintain or produce a minimum of ten full-time tasks for united state workers within 2 years of the investment. These task development metrics are vital, as they guarantee that the investment adds positively to the united state economic climate. Satisfying these monetary and employment criteria is critical for UK residents seeking to safeguard their EB5 visa and eventually get U.S. residency.

Choosing the Right Investment Opportunity

Choosing the ideal financial investment possibility is important for UK people seeking an EB5 visa. The option can significantly impact both the success of their application and the capacity for economic returns. It is necessary to evaluate tasks based on their conformity with EB5 demands, such as work production and investment amounts. In addition, financiers should think about the credibility and track document of the Regional Center or project programmer. Thorough due persistance is required, including assessing organization strategies, monetary estimates, and market analyses. Recognizing the market and location of the financial investment can affect the chance of task success. Eventually, a well-researched and purposefully chosen investment can lead the way for a smoother shift to U.S. residency.

The Application Process Explained

The application process for the EB5 visa involves several important steps that UK people should understand. This consists of an introduction of qualification needs, a detailed step-by-step guide, and understandings right into common obstacles dealt with throughout the application. EB5 Visa. Guiding via this procedure efficiently can substantially influence the success of acquiring the visa

Eligibility Needs Summary

Navigating the EB5 visa procedure requires a clear understanding of the eligibility demands set forth by united state migration authorities. Initially, applicants must invest a minimum of $1 million in an U.S. business, or $500,000 in a targeted work area. The investment needs to produce or protect a minimum of 10 permanent work for U.S. employees within two years. Furthermore, the applicant should show the resource of their financial investment funds, guaranteeing they are obtained legally. Applicants need to additionally be able to reveal their energetic involvement in the organization, although everyday management is not strictly required. Candidates have to fulfill specific personal background checks, consisting of no criminal background that would invalidate them from obtaining a visa.

Step-by-Step Application Guide

Steering through the EB5 visa process entails numerous important actions that require cautious focus to information. First, candidates should pick a suitable EB5 job, guaranteeing it meets the needed investment limit of $1 million or $500,000 in a targeted employment area. Next, they need to gather required documents, consisting of evidence of funds and individual details. When put together, candidates submit Type I-526, the Immigrant Application by Alien Financier, to USCIS. After authorization, people may get a visa at a united state discover this info here consulate or change their standing within the U.S. Ultimately, upon going into the U.S., capitalists must meet the financial investment requirements and documents Form I-829 to get rid of conditions on their residency after 2 years.

Typical Application Obstacles

Navigating the EB5 visa process can provide numerous difficulties that candidates must be prepared to face. One common hurdle is collecting the called for paperwork, which includes proof of investment funds and business plans that satisfy united state standards. Candidates may also have a hard time with passing through complex regulations and making sure compliance with both U.S. migration legislations and investment requirements. Furthermore, the prolonged handling times can lead to unpredictability and anxiety. Miscommunication with immigration officials or misconceptions pertaining to demands can additionally complicate the journey. Choosing a suitable investment job is essential, as bad options might endanger the application. Recognition of these obstacles can much better gear up UK people in their search of united state residency with the EB5 visa program.

Usual Obstacles and How to Get rid of Them

What challenges might UK citizens come across when obtaining an EB5 visa? One considerable obstacle is the requirement for a minimum investment of $900,000 in a targeted work area or $1.8 million otherwise, which can be an economic pressure. Additionally, maneuvering through the complex U.S. migration system can be daunting, typically causing complication about documents and treatments. Applicants might also face lengthy processing times, possibly postponing their residency plans. To get over these difficulties, UK people are recommended to seek support from migration attorneys experienced in EB5 applications, making sure appropriate documentation and compliance with guidelines. Creating a strong financial investment strategy, together with complete research study on regional centers, can also improve the possibility of a successful application.

Benefits of the EB5 Visa for UK Investors

While going across the intricacies of immigration law can be daunting, the EB5 visa provides various benefits for UK financiers looking for long-term residency in the USA. To start with, it provides a pathway to visa for capitalists and their immediate member of the family, promoting a smoother modification for households. On top of that, the EB5 visa does not call for a work deal or sponsorship, enabling better autonomy in the investment process. It offers the capacity for a lucrative return on financial investment through job production in targeted employment locations. UK capitalists profit from expedited processing times, enhancing their possibilities of protecting residency sooner. In general, the EB5 visa stands as a robust alternative for UK nationals aiming to establish a footing in the USA.

Frequently Asked Concerns

Can I Request the EB5 Visa Without Prior U.S. Residency?

Yes, an individual can get the EB-5 visa without previous U.S. residency. The program is developed for foreign financiers looking for to acquire permanent residency with financial investment in united state services, despite their previous residency standing.

What Is the Processing Time for the EB5 Visa?

The handling time for an EB5 visa generally varies from 12 to 24 months. Nevertheless, this duration can vary based on elements such as application completeness and the workload of the U.S. UK Citizen US. Citizenship and Immigration Providers

Are There Restrictions on My Financial Investment Funds' Source?

Yes, there are restrictions on the resource of mutual fund for the EB5 visa. Candidates have to demonstrate that their funds stem from authorized resources, ensuring conformity with united state immigration and anti-money laundering policies.

Can My Family Members Accompany Me on the EB5 Visa?

Yes, member of the family can go along with the key EB5 visa applicant. This includes spouses and single children under 21, enabling them to acquire conditional permanent residency together with the capitalist as component of the application process.

Will My EB5 Financial Investment Be Returned After the Visa Approval?

The EB5 investment is generally kept in a designated project for a specific duration. Upon successful visa authorization and meeting criteria, investors might receive their capital back, although this is not assured and depends upon task performance.

The EB5 Visa program presents an organized technique for UK people seeking U.S. British Investor. residency with financial investment. The EB5 Visa Program was established to promote the United state economic climate through international financial investment, it likewise uses a pathway for UK people seeking irreversible residency. If the financial investment is made in a targeted work location (TEA), which is defined as a rural area or one with high joblessness, the minimum financial investment drops to $800,000. While seeking an EB5 visa, UK people have to navigate certain investment amounts and task production standards set by the U.S. federal government. The basic financial investment requirement is currently $1 million, yet this amount may be reduced to $500,000 if the investment is made in a targeted work location (TEA), which is identified by high joblessness or low populace density